HK Stock#3 - Discounted retailer in HK

Does this discounted retailer stand a chance to withstand retail sector pressure?

Hong Kong’s retail sector is in doldrums, taking multiple beatings on different fronts. After almost 3 years (2020-2022) of on-and-off restrictions during COVID, Hong Kongers seem to be engaged in “revenge travelling”. On 8th June 2024 (3-day weekend due to the Dragon Boat Festival), over 520k1 Hong Kong residents departed from various border checkpoints, representing c.7% of total population. The savings pool piled up during COVID is being spent on trips across the border in Shenzhen, as well as in countries like Japan (depreciating Yen!) and Taiwan. Moreover, the lure of online shopping (HKTV Mall, Taobao etc.) has continued to hurt physical retailer. Naturally, domestic retail spending and consumption has been impacted negatively. The HK Retail Management Association (HKRMA) has warned that retail sales could fall by low double-digits in 2024. Despite the “demise” of retail in HK, is there any hope for a discounted retailer to perform?

Source: HKFP

The stock discussed below is International Housewares Retail Company Limited (IH Retail, 1373.HK). It trades at a mere 5x earnings and a mouth-watering 15% dividend yield (ex-special dividend) on FY232 reported numbers. Current market capitalization is HK$930mn (c.US$120mn), while enterprise value3 is HK$1.1bn. With an EV/EBIT of 5x and P/B of 1x, the stock will probably look enticing to a value investor, so let’s see what this discounted retailer has to offer.

Introduction: IH Retail began operations in 1991, with the first store opened in North Point (北角) on the Hong Kong Island, selling various household products. Today, the company has expanded to a total of almost 380 stores (HK: 318, Singapore: 48, Macau: 8, and 5 licensed stores in Malaysia, Cambodia, Australia and Vietnam). The current market cap suggests an average value of roughly HK$2.5mn/store, v.s. average operating profit on FY20 (i.e., pre-COVID) per store of HK$620k (I leave it to the readers on how they would want to interpret this). The company has over 650 suppliers in 13 regions. Over 30 years of operations means the company has built extensive sourcing channels and strong supplier relationships. The firm also sells self-manufactured private-label products e.g., plastic containers, mirrors/frames etc.

Their stores tend to sell a wide-range of products at relatively affordable prices. Products include kitchenware, food & beverage, toiletries, personal care, electronics, stationery and so forth. The brand is very well-established, and HongKongers are typically aware of Japan Home Centre (JHC) stores. The company also has several other retail outlets with smaller footprint, including 123 by Ella (trendy retail) and Day Day Store (snacks, personal care etc.). There are 8 “Concept Stores”, which have 8 different product zones and cater to a wide array of customer needs. Aside from physical retail, the company runs JHC eShop, an online platform that allows both self pick-up and home delivery. Unlike many other countries and cities, HK and SG are both dense and small places, which means people typically like to shop physically. Online shopping, while definitely a secular threat, is less impactful to physical retail as compared to Western countries such as US and UK, in my view. While online retail sales4 in HK went up 40% and 20% in 2021 and 2022 respectively, they fell 6% in 2023 and have stagnated so far in 2024.

Source: TimeOut

Brief timeline: After the first store commenced operations in 1991, the company opened an iconic “HK$10” store in 1993, a similar concept to what we see with Dollar General and Dollar Tree in the US. While the company has mostly grown organically, IH Retail acquired Nippon warehouse in 2000 and also acquired 17 stores under Quality Housewares in 2007. The company exceeded 200 stores in 2009 and went public in 2013 on the main board of SEKH, at a price of HK$2.81/share (more than double the current stock price).

Founders and Ownership: The company’s co-founder, chairman, and CEO - Lisa Ngai Lai Ha, is an admirable figure. Being a working mother, she has grown alongside the firm despite facing multiple challenges and business cycles in over 3 decades. In an interview, she had mentioned that their store in the early days had caught fire and almost all inventory was lost, but their diligence and perseverance kept them going. As she is 51 years old, she will likely continue running the firm for the next 7-8 years. The other co-founder - Peter Lau Pak Hai, who is 65, resigned as CEO in early-2016 and started his career in the trading (import/export) business before opening the first JHC store. The deputy CEO, Kathryn Ho, has over 30 years of retail sector experience across leading chains in HK (Watsons, Parknshop, SaSa, City Chain). The two founders have almost 50% stake, while renowned activist investor - David Webb, holds 8% share in the company. Institutional ownership is only 1.6%, as per data from IBKR.

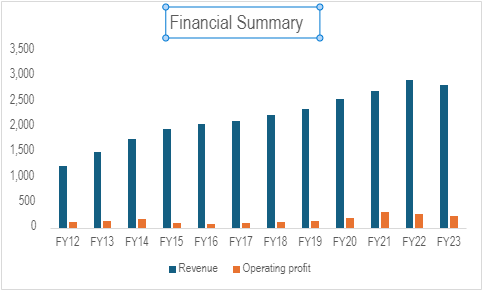

Financials: The company has consistently grown over the past decade, with revenue CAGR of 8% from FY12-23, with operating profits growing at a slightly lower CAGR of 7%. Almost all revenues are generated from retail, with a minuscule portion from wholesale, licensing and other income. To further achieve efficiency, IH retail is deploying in-store automation technologies (e.g., self-checkout, digitalization of price tags), which should improve profitability in the medium-term. While there is no specific dividend policy, the company had a c.80% payout ratio from FY18-23, translating to historical dividend yield of over 8% per annum. Balance sheet is debt-free, and cash balance stood at HK$318mn as of October 2023. As the company has no aggressive overseas expansion plans and the co-founders have a sizeable stake in the business, a stable business performance likely means dividend continuity.

Source: Company

Why does an opportunity exist?

Newspapers have widely covered the poor state of retail in HK and undoubtedly, there has been undue pressure on many small retailers. The trend of consumers going north to Shenzhen across the border has also reduced dollars spent locally. Nevertheless, IH Retail is a value-for-money, high-quality and multi-category retailer that is catering to a growing class of value-conscious consumers who are going through a lengthened inflationary environment. With over 1mn J Fun (customer loyalty program) members, the company constantly offers discounts, coupons and deals to customers. As more small-scale, single-chain retailers struggle in this environment, chained stores like JHC and others such as Best Mart 360 (2360.HK) and 759 阿信屋 (759.HK) are likely to capture higher wallet share and withstand near-term pressures.

Do I think the stock can double from here? Probably not, but there is sizeable upside based on a simple analysis: Taking pre-Covid operating profit of HK$200mn5 and using 6 and 8x EV/EBIT multiples and subtracting net debt (including leases) as of October 2023, we get equity value of HK$1.2 and HK$1.8 per share respectively (v.s. current price of HK$1.3). Instead of thinking in absolute terms, there seems to be more upside relative to downside, along with steady dividend income (low double-digit yield). Favorable to some investors I presume?

Key risks: Rising rental and labor costs, competition from online platforms (e.g., Taobao), poor store expansion policy. While increased outbound travel by HongKongers is a risk, I do think it is more short-term in nature and is taking more share of discretionary spending (restaurants, higher-value goods, experiences such as spas/massage/entertainment etc.) than compared to everyday goods.

I would highly appreciate if you could share this with fellow investors and am more than happy to engage/discuss alternate thoughts that you may have!

Hong Kong Immigration Department Statistics

Year-end is April 30th for the company.

Market Cap + Net debt including lease liabilities

HK Census and Statistics Department. Online retail refers to sale of goods through electronic devices by local retail establishments.

The company actually was a COVID beneficiary (masks, test kits, hand sanitizers etc.) and hence pre-COVID OP is a more reasonable number to look at.

I just found and included this post in my Monday links collection posts - Emerging Market Links + The Week Ahead (August 19, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-august-19-2024 Not familiar with this store or stock but this type of store seems to have alot of competition - at least in SE Asia e.g. Daiso, etc and from the picture you included, more geared for higher income places like Singapore and HK...

What do you see as the issue with their store expansion policy? Around half their stores are in the NT, and their stated strategy seems to be aligned with govt / developer focus to increase housing supply in the NT.