In another strong year for risk assets, the Hang Seng Index (HSI) climbed 18% YTD, outperforming c.11% for MSCI AC Asia Pacific Index (ignoring FX differences). HSI had struggled in recent years, declining over 13% in 2023 and 15% in 2022, after a move towards a higher US rates regime. Despite the Fed cutting rates by 100 bps this year (25 bps overnight), recent narratives have pointed to a “higher for longer” environment. This compares very differently to the recessionary fears at the start of 2024, and forecasters are now pointing to continued growth in 2025.

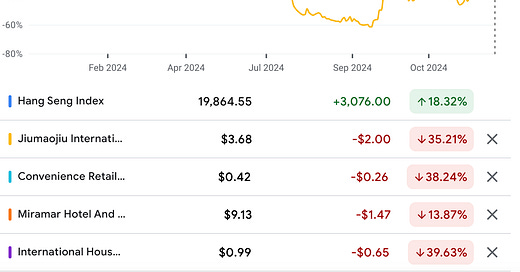

4 of the stocks in my substack write-ups have fared poorly YTD, with 3 of them down over 35% and 1 down 14%. As such, it’s appropriate to reflect on some learnings.

Investing in companies that solve inherent problems by providing goods/services and have sound fundamentals (sales and EPS growth) typically generates decent returns. Not many stocks in HK fall under this category, given challenging growth backdrop, not to mention questionable corporate governance practices and poor capital allocation decisions (e.g., lack of stock buybacks). Daniel Rupp, a value investor running his own shop after having spent many years at the famous Overlook Investments, had highlighted how corporates in HK could boost shareholder value in an SCMP article earlier this year. Unfortunately, corporate management teams and boards have not done a great job in this respect.

Coming to the 4 stocks, I highlight what I have learnt from each of these this year:

1. Miramar - Holding deep value stocks (trading close to cash + investments level) that have no growth prospects and lack of expansion plans is unlikely to make you any money. The 5% dividend yield is a good to have, but the “dividend carry” will only double your money after 14 long years (rule of 72). This is quite unattractive for most investors, and in an environment where investors in Microstrategy have 5x-ed their money YTD.

2. IH Retail - Investing in a secularly challenged industry despite sound fundamentals is a difficult proposition. The demise of retail has been well-documented, and apps like Taobao have eaten up the lunch of retailers. HK retail has been even more challenged from pro-longed Covid impact and trend of HongKongers going up north to Shenzhen for consumption and shopping. I am a big fan of the founders of IH retail and their track record, but a great sailor may not necessarily save a sinking ship in turbulent waters.

3. CR Asia - A boring business offering undifferentiated products with many similar competitors cannot produce stellar returns. Despite low double-digit dividend yield, a boring bakery business without any competitive advantage in a saturated market has been a stupid decision.

4. Jiumaojiu - This was the name I was most enthusiastic about, given the Chinese government’s focus on increasing domestic consumption. Hotpots are a Chinese favourite, and are consumed widely and repeatedly (albeit not at daily or weekly frequency). Nonetheless, investing in a market with a challenging macro environment and consumption being weak meant the stock failed to perform this year.